Unlocking Growth with Secured Finance

What is secured Business Finance

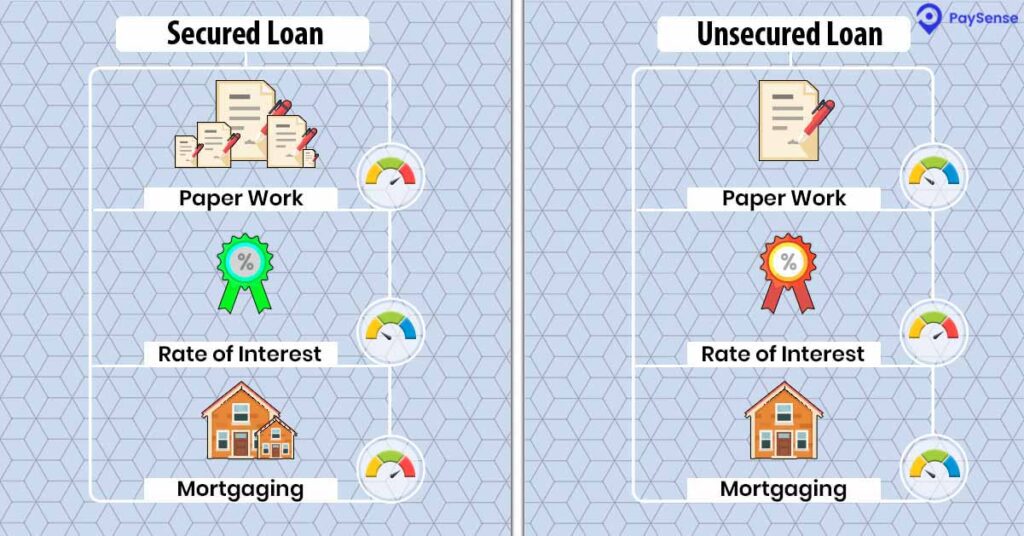

Secured finance refers to loans or credit agreements that are backed by collateral—an asset that the borrower pledges to the lender to reduce the risk of default. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover the outstanding amount. Common examples of secured finance include:

Mortgage Loans: The property being financed serves as collateral. If the borrower defaults, the lender can foreclose on the home.

Auto Loans: The vehicle itself is collateral. If payments are missed, the lender can repossess the car.

Secured Personal Loans: These loans may be backed by savings accounts, certificates of deposit, or other personal assets.

Understanding Secured Finance

Collateral

In secured finance, the borrower provides an asset (collateral) that the lender can claim if the loan is not repaid. Common collateral includes real estate, vehicles, or equipment.

Loan Agreement

The borrower and lender agree on the loan terms, including the amount, interest rate, repayment schedule, and what happens in the event of default.

Lower Risk for Lenders

Because the loan is backed by collateral, lenders face less risk. If the borrower defaults, they can seize the collateral to recover their losses.

Tailored financing for your business goals. Trust our expertise for seamless business loan assistance.

Benefits of Secured Finance

Lower Interest Rates: Secured loans typically come with lower interest rates than unsecured loans, as the collateral reduces the lender's risk. Higher Loan Amounts: Borrowers can often access larger sums of money since the loan is backed by an asset, making it easier to fund significant expenses. Easier Approval: Secured loans can be easier to obtain, especially for borrowers with limited credit histories or lower credit scores, due to the added security for lenders. Flexible Terms: Lenders may offer more flexible repayment terms and conditions, helping borrowers manage their finances more effectively. Access to More Financing Options: Secured finance opens up various funding options, including mortgages, auto loans, and business loans. Potential for Credit Building: Successfully repaying a secured loan can help improve the borrower’s credit score, enhancing future borrowing opportunities. Utilization of Assets: Borrowers can leverage existing assets (like property or equipment) to obtain financing without needing to liquidate them. Financial Security: Secured finance provides a safety net, as borrowers know they have a structured way to manage significant purchases or investments. Tax Benefits: In some cases, interest payments on secured loans may be tax-deductible, providing potential savings. Encourages Responsible Borrowing: The requirement of collateral can promote more cautious borrowing and spending practices, as borrowers are more invested in the loan's outcome.

Common Types of Secured Finance

Choosing the Right Lender

Reputation: Research the lender’s reputation through reviews, ratings, and customer feedback. Look for lenders with a history of good customer service and transparency.

Loan Options: Evaluate the variety of loan products offered. A lender with diverse options can better meet your specific needs.

Interest Rates: Compare interest rates across multiple lenders. Even a small difference can significantly impact the total cost of the loan.

Fees and Costs: Look beyond interest rates to understand any additional fees (origination fees, closing costs, etc.) that could affect your overall expenses.